Sales on the European construction equipment market went down by 6.4% in 2020. This seemingly modest drop is due to the performance of high-volume light and compact equipment, whose sales were almost unaffected at -3%. In contrast, heavy construction machinery suffered a 19% fall in sales, in what emerged as a challenging year. Indeed, less expensive machines were sold at almost normal levels during the pandemic, while investment in more capital-intensive equipment suffered from economic uncertainty.

These economic figures are the result of a combination of anticipated cyclical downturn after years of growth and a slowdown in business activity due to the Covid pandemic. Unlike earlier years, earthmoving equipment, road equipment, concrete equipment, and the tower cranes business experienced similar market patterns, despite the impact of stronger sales of light equipment.

Presenting the report to the press, CECE President Niklas Nillroth focused on the positive aspects of last year’s results and this year’s expected outcome. “As we all know, 2020 was the most unexpected and unpredictable of years. From an economic point of view, it represented a year of disruptions with certainties and forecasts crumbling before our eyes. However, as you will see in our report, the construction and industrial sectors in Europe have shown a great amount of resilience and capability to rebound quickly, limiting the damages of the first semester. The foreseeable boost in construction and infrastructure activities from the European Recovery Plan represents another reason to remain optimistic for the near future.”

2020 began in line with expectations, with a 5% market decline in the first quarter – a cyclical downturn that had been anticipated.

However, in the second quarter, lockdowns across Europe began to take their toll and pushed the market to 28% below the levels of the previous year.

The decline in sales in Q2 also reflected the impact of the comparison with the quarter in 2019 when the bauma exhibition was held, and the usual short-term boost in sales from it. With relaxation of lockdown measures in Q3, sales reached similar levels as 2019 and were flat yearon-year. The last quarter of the year saw the expected improvement in demand, and sales in Europe went up by 9%. This also reflected the benefit of business postponed in the first half of the year materializing in Q4.

From a geographical perspective, market sales in most countries reflected the impact of the pandemic and the lockdowns, but there were a few exceptions. Most notably, the Italian market reached the same level of sales as 2019, and the Turkish market recovered from its 2019 crash.

Outlook 2021

While the short-term macroeconomic outlook remains uncertain, with further risks from the spread of Covid variants, the business climate within the European equipment industry remains positive. After months of improvement, the business climate index in CECE’s Business Barometer survey is significantly higher in March 2021 than at the outbreak of the pandemic in spring 2020. A significant majority of manufacturers expects business to grow in the first half of the year, and the level of satisfaction with current business has also improved significantly. In addition, the order intake for European manufacturers has been growing year-on-year since December 2020 and, sales on the European market are also on a clear growth path. This is consistent with the improvement in equipment sales seen in Q4 2020.

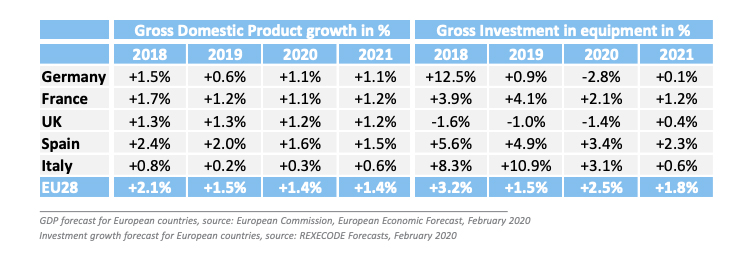

A forecast of 5% growth in the European equipment market is a realistic assessment of prospects for 2021. However, against a background of continued uncertainty and high absolute levels of sales, even a flat market in 2021 would not be a disappointment.

The world market is also likely to show moderate growth in 2021, but the volatility of the Chinese market and its significant influence on the overall outcome means that it is difficult to quote reliable figures for overall global growth levels. In the medium term, the construction equipment industry faces many substantial risks. One of them are higher debts in many countries that will become a problem, as public infrastructure investments will suffer when austerity measures must be put in place.

About the Report-again

The CECE Annual Economic Report contains sections on the macroeconomic situation, the performance of the construction sector, the main markets, and main segments of the European construction equipment industry. The report also includes information from the national CECE member associations, shedding more light on regional developments in the European construction equipment sector.

Germany as a business location after the Corona crisis: the VDMA report

The analysis at the end of 2020

VDMA reported a 17% fall in equipment production in 2020 was less than was feared, compared with the previous year. The association said sales totaled €10.5 billion, comparable to the volume of sales made in 2017, and considerably better than had been feared.

At VDMA’s annual general meeting was reported that sales of compact construction equipment in Germany were only minimally affected by the pandemic, seeing a decline of just 3%.

The German government’s economic stimulus package

The German government’s economic stimulus package and the European reconstruction fund “Next Generation EU” (NGEU) pursue transformative goals that will change Germany and Europe as a business location in the medium to long term.

The German government’s economic stimulus package adopted in June 2020 to overcome the Corona crisis not only provides for measures to bridge economic difficulties in the short term, but also a package for the future that will have an impact on the framework conditions of Germany as an industrial location.

Here, research and development, as well as investments in the areas of climate-friendly mobility, sustainable energy supply, digitalisation as well as health protection, are particularly worth mentioning. The reconstruction fund set up at the European level can even be classified as a procyclical package to promote cohesion and structural change.

“Mechanical and plant engineering is also concerned with getting out of crisis mode as quickly as possible. The joint task of politics and industry is: How do we shape the economic world in the post-pandemic era?” said

Karl Haeusgen, VDMA President.

Copyright 2017-2023 All rights reserved.

Copyright 2017-2023 All rights reserved.