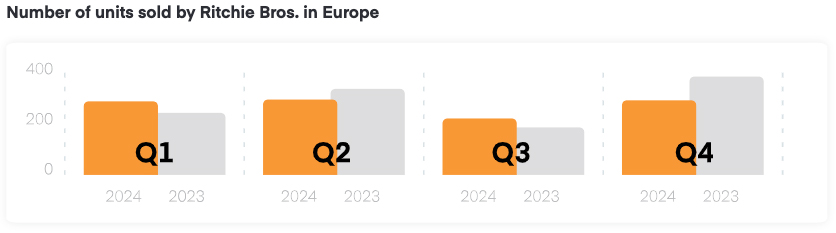

According to the Q4 report by Ritchie Bros, in 2024, as the European construction and contracting market faced ongoing challenges, used equipment sales have also decreased, even if only slightly.

High building costs are likely to remain a key factor affecting the speed of recovery. The Nordic countries, however, have shown quicker progress, while much of Europe is still working through a slower comeback. The slowdown in the sector is mainly due to higher interest rates, rising building costs, and a more saturated market.

While there are early signs of improvement, a stronger recovery isn’t expected until later in 2025.

On a positive note, many construction companies have already received building permits, setting the stage for growth as the market picks up in 2025. Lower demand for machinery during this quieter period suggests the recovery will rely more on steady long-term needs. This also creates opportunities for growth in the market for used equipment, which could see increased interest, especially if borrowing costs become more manageable for buyers.

- Crawler excavators: ⬇21% decrease in the median price at auctions compared to the same period last year.

- Mini excavators: ⬆ 27% increase in Ritchie Bros. auction sales compared to Q4 2023.

- Telescopic handlers: ⬆27% increase in the volume of listings on Mascus.

Crawler Excavators

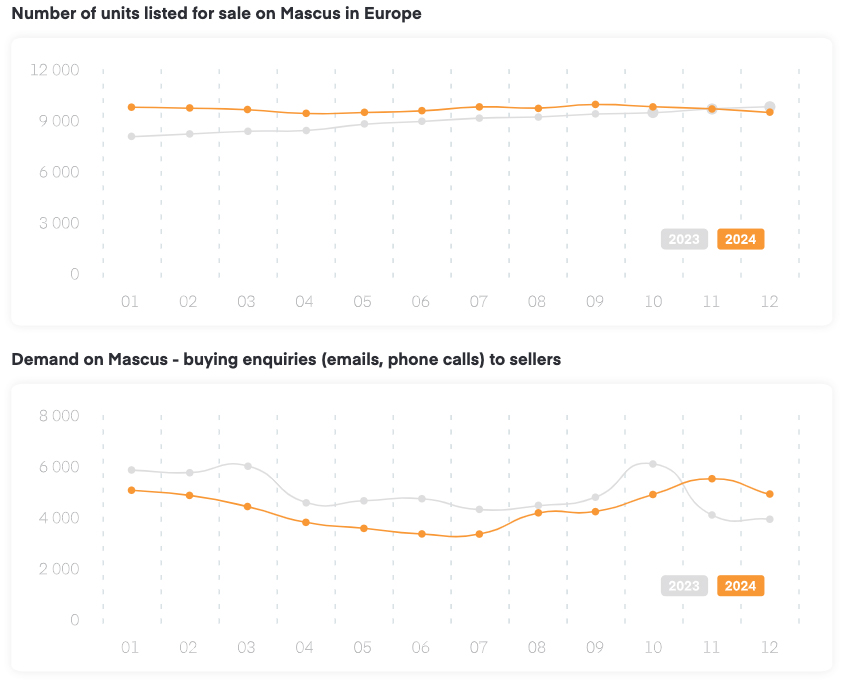

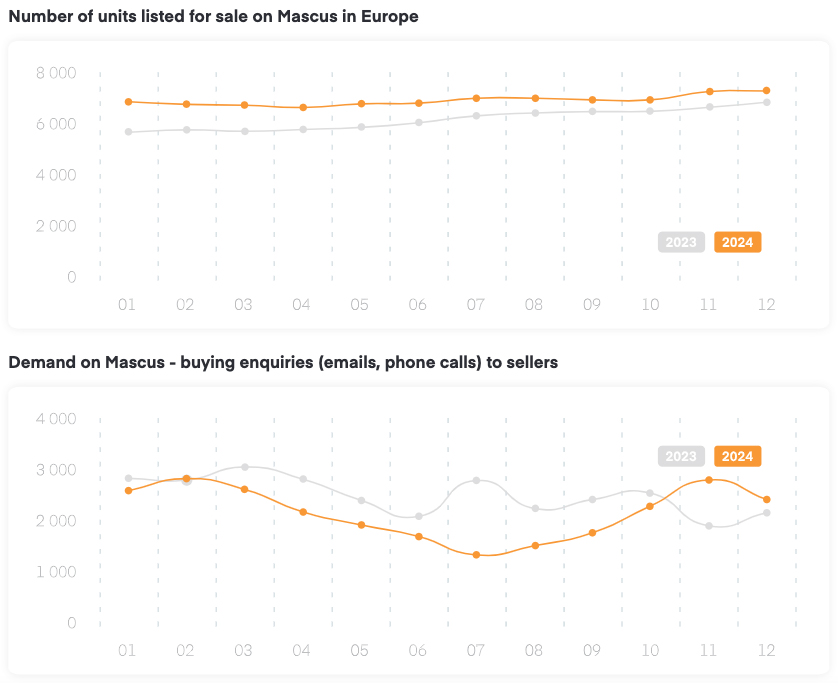

During Q4 2024, the average volume of crawler excavators listed for sale on Mascus was flat (0%) compared to the same period last year. Demand for crawler excavators on Mascus (email contact requests and direct calls) did grow in the quarter, however, with a 9% increase compared to Q4 2023.

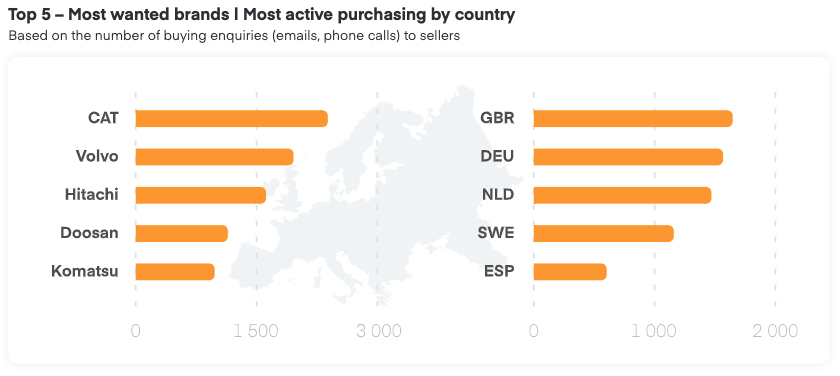

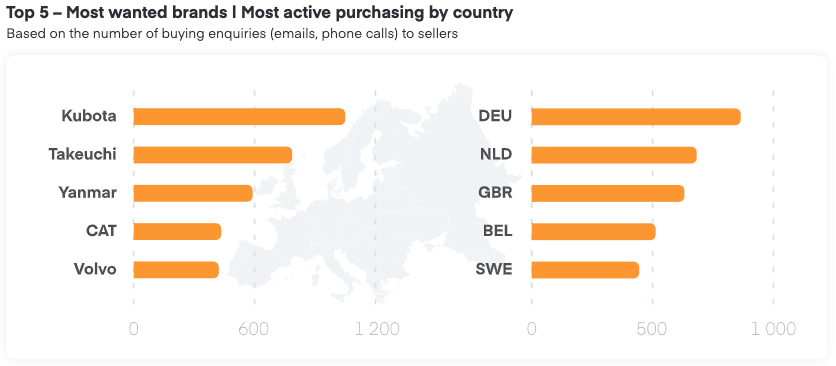

Caterpillar was the most in-demand brand, while Volvo and Hitachi made up the top three. The top-buying country of crawler excavators through Mascus for Q4 was the United Kingdom, followed by Germany and the Netherlands.

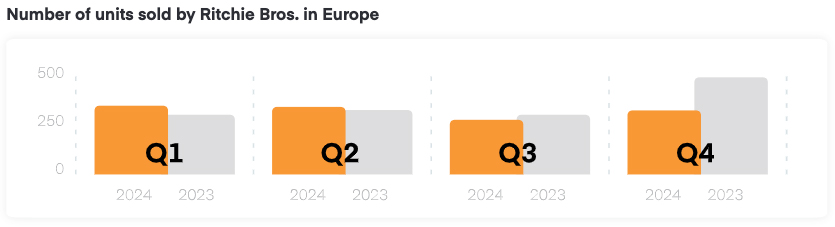

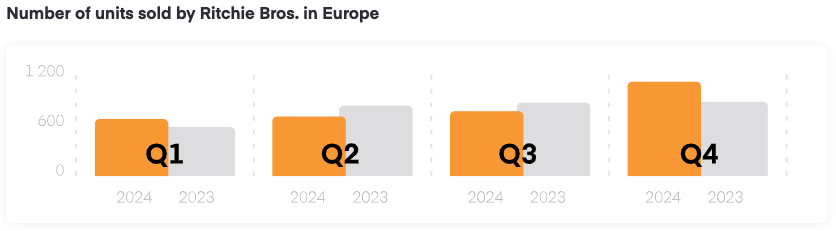

The median price for crawler excavators sold at Ritchie Bros. auctions dropped in Q4 2024 – down 21% compared to the same period in 2023. Demand was also relatively weak, with sales down substantially at 34%.

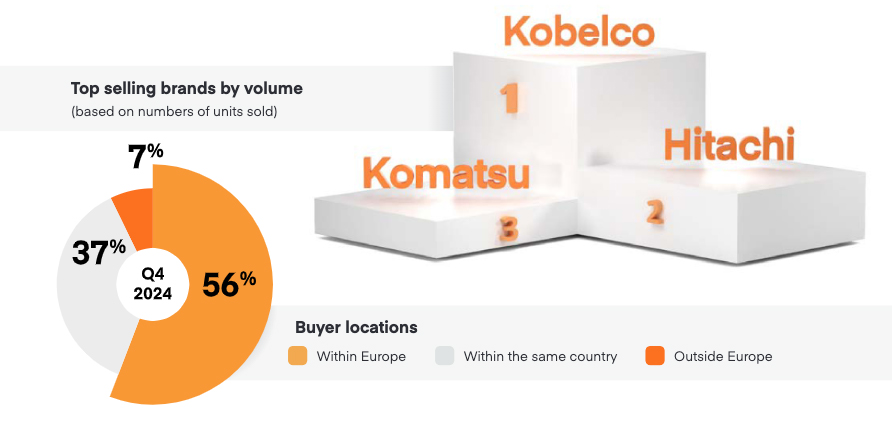

By the number of units sold, Kobelco, Hitachi, and Komatsu were the top-selling brands in Q4. The most popular crawler excavator model sold was the Kobelco SK85MSR-3E (17 units sold for a median price of €23,444). By geographic location, more than half of the crawler excavators (56%) were sold within Europe, while 37% went to local buyers. The top buying

countries of crawler excavators in Q4 were Spain, Italy and the United Kingdom.

Mini Excavators – The most sold mini excavator was the supercheap Chinese JPC HT12 model

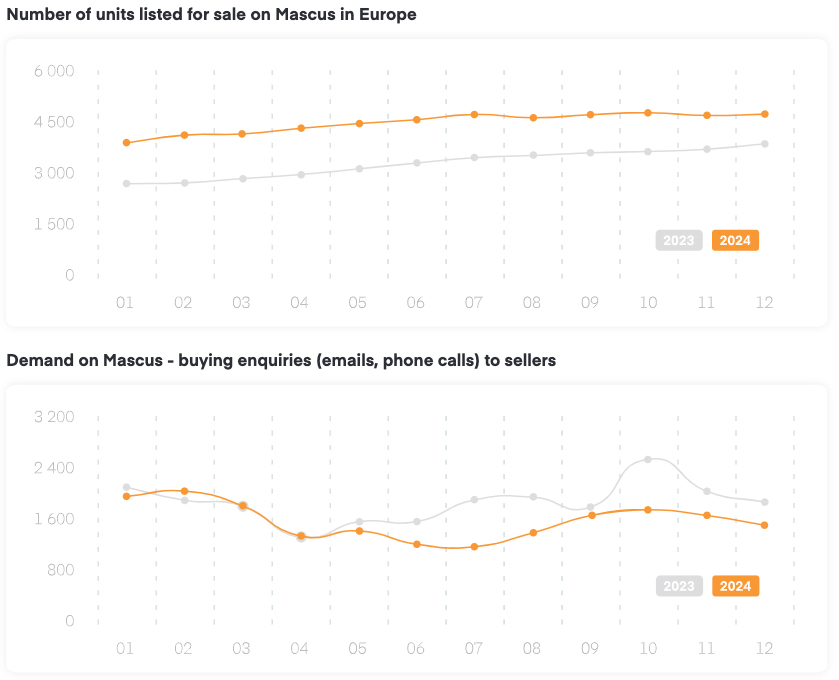

The volume of mini excavator listings on Mascus grew during Q4 2024. Average listings per month were up 8% compared to the same period last year. Demand was also up by 14% (email contact requests and direct calls) for mini excavators on Mascus compared to Q4 2023.

The most in-demand brand was Kubota, followed by Takeuchi and Yanmar. Buyer demand for mini excavators was strongest in Germany, the Netherlands, and the United Kingdom.

Median pricing for mini excavators at Ritchie Bros. auctions saw a minor drop in Q4 2024. Average median prices were down only 3% compared to the same period in 2023. Auction sales did rise about 27% from the same period in 2023.

JPC leaped into the top spot in Q4 for number of units sold at Ritchie Bros. auctions. Kubota and Volvo followed in second and third, respectively. The most popular mini excavator model sold was the JPC HT12 (131 units sold for a median price of €2,432). More than half of the mini excavators (58%) were sold locally within the same country, while 40% went to buyers within Europe. The top buying countries of mini excavators in Q4 were Italy, Spain, and France.

Telehandlers

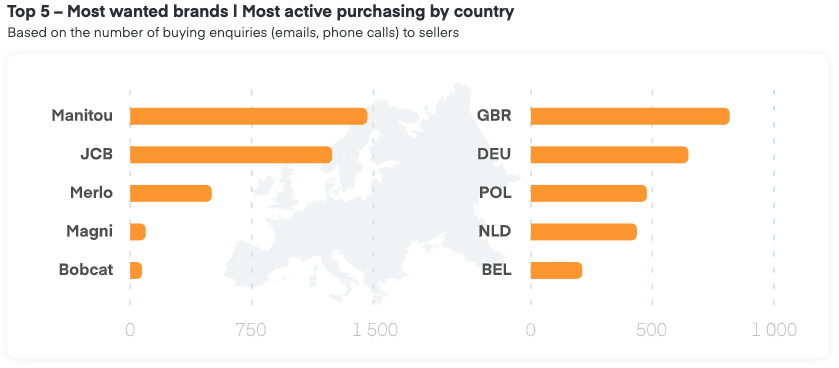

During Q4 2024, the volume of telescopic handlers listed for sale on Mascus grew by 27% compared to the same period last year. Overall, demand decreased by an almost equal amount 24% (email contact requests and direct calls) for telescopic handlers on Mascus compared to Q4 2023.

Manitou was the most in-demand brand, while JCB and Merlo made up the top three. The top-buying country of telescopic handlers through Mascus for Q4 was the United Kingdom, followed by Germany and Poland.

Telescopic handler sales in Q4 through Ritchie Bros. auctions saw a drop of 24%, while the median price moved up slightly to 5% compared to Q4 2023.

By the number of units sold, the top-selling brand in Q4 was JCB followed by Manitou and Merlo. The most popular telescopic handler model sold was the JCB 540-170 (25 units sold for a median price of €44,899). By geographic location, less than half of the telescopic handlers (44%) were sold to buyers within Europe, while 45% went to local buyers within the same country. The top buying countries of telescopic handlers in Q4 were Italy, the United Kingdom, and Poland.

Copyright 2017-2025 All rights reserved.

Copyright 2017-2025 All rights reserved.