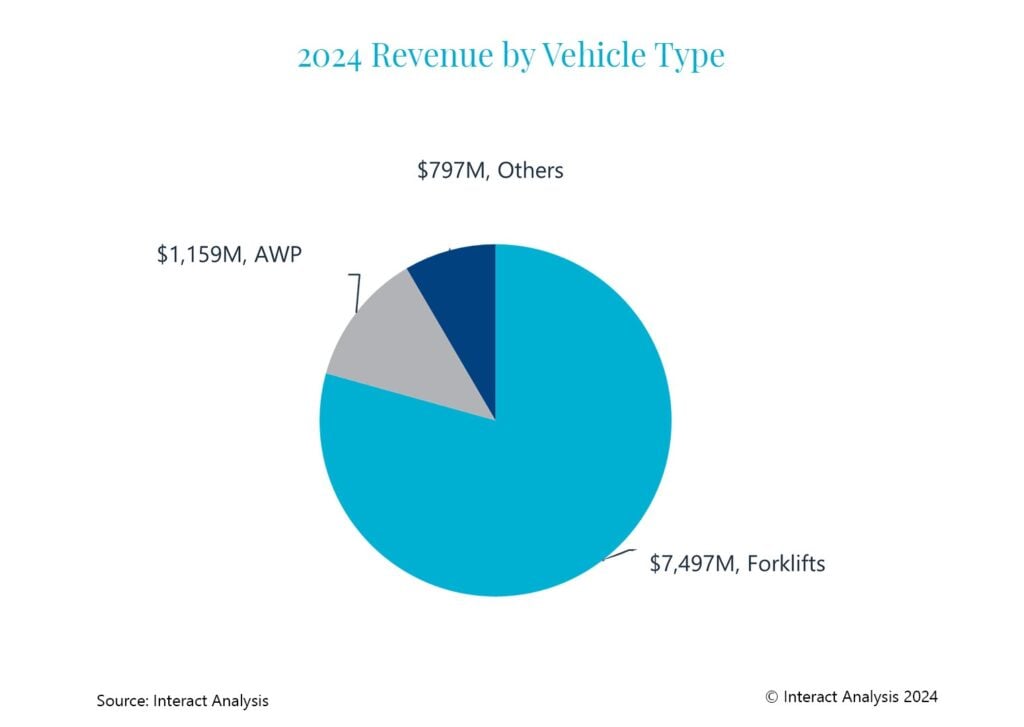

According to Interact Analysis’ latest off-highway powertrain report, the sector is undergoing rapid transformation, but significant hurdles remain. While the off-highway powertrain market is advancing towards electrification and it remains a long-term priority for the sector, diesel will continue to dominate for several more years due to high costs, a lack of regulatory support, and economic and technical challenges. The sector is predicted to reach total component sales of $9.5 billion in 2024. As battery technology improves and OEMs refine their strategies, electrified off-highway vehicles will constitute a far larger segment of the market by 2030, providing new growth opportunities for component vendors and integrators.

Forklifts and AWP drive electrified vehicle sales

Forklifts alone account for a substantial share of the electrified off-highway market, with $7.5 billion in component sales forecast in 2024, driven by high utilization rates and a well-established presence in electrified powertrains. Yet, for other machinery types, particularly telehandlers and wheel loaders, adoption rates remain low, as these vehicles continue to rely heavily on diesel. Interact Analysis forecasts a 7% growth in electrified off-highway vehicle sales for 2024, which is lower than previously anticipated, suggesting that the industry’s transition remains in its early stages.

Regional and economic constraints slow transition to EVs

Outside of China, electrified vehicle shipments have been constrained by high interest rates and limited government incentives. In contrast, China has shown robust growth in electric wheel loader registrations, contributing to Asia Pacific’s stronger performance in electrified vehicle sales. Globally, sluggish economic growth and increased financing costs have made it difficult for construction companies to justify the high upfront costs of electric alternatives, restricting investment in electrified off-highway equipment.

Government policies play a crucial role in market development. Outside of Scandinavia, few countries have implemented stringent regulations to phase out diesel in off-highway equipment or promote electrification. As a result, diesel powertrains are likely to maintain a significant presence well beyond 2030 in most regions.

Battery packs drive off-highway powertrain revenues

The off-highway market’s demand for specialized, ruggedized components contributes to higher costs per kilowatt-hour (kWh) than passenger and commercial vehicles. For most off-highway machines, battery packs cost between $300 and $500 per kWh. Although some modest cost reductions have been observed, the report highlights overall pricing has not declined as swiftly as predicted.

Battery packs are expected to remain the largest revenue generator in the sector, but an increase in motor and inverter demand is anticipated as larger, higher-power OHVs electrify. The trend is expected to enhance revenue prospects for vendors of customized, heavy-duty components designed to withstand the unique demands of the off-highway environment.

“The path to electrification in the off-highway sector is a nuanced journey, driven by both technological advances and economic headwinds. While forklifts and aerial work platforms lead the charge, widespread adoption across larger machinery will take time, hindered by high component costs and limited regulatory pressures. Yet, as battery technology advances and market dynamics shift, the sector is on a steady course toward a more electrified future.”

said Jamie Fox, Principal Analyst at Interact Analysis.

Source: Interact Analysis

Copyright 2017-2025 All rights reserved.

Copyright 2017-2025 All rights reserved.