Construction Equipment Market size is estimated to grow from USD 180.4 billion in 2022 to reach USD 223.1 billion by 2027, at a CAGR of 4.3% during the forecast period, according to a new report by MarketsandMarkets. The market is expected to witness growth due to an increase in urban infrastructure projects and the adoption of advanced technologies in the construction industry.

Construction equipment would be the fastest growing segment over the forecast period

The upcoming emission regulations have much-lowered emission limits, requiring advanced engine technologies and after-treatment devices. It would eventually increase equipment costs between 15-25%, resulting in increased capital investment for fleet owners and lowered ROIs. Additionally, the battery technology needs more time to address the issues related to charging time, range, and cost. Hence, alternate fuel equipment is the option for OEMs in the near future. The CNG/LNG/RNG are the best options for construction equipment in the coming years. Compressed Natural Gas emits 25% less sulphur, nitrogen, and carbon pollutants than gasoline engines. RNG emits 70% lesser Greenhouse Gases than diesel or gasoline, making it the most environment-friendly fuel. Liquefied natural gas (LNG) is mostly methane that has been cooled down to convert it into liquid form. Many major construction equipment manufacturers are focusing on developing the alternate fuel models. For instance, in May 2022, at EXCON Expo in India, Tata Hitachi launched the ZW225 wheeled loader with which is compliant to CNG. Also, in November 2020, JCB launched dual fuel CNG backhoe loader named JCB 3DX DFi in India. This new machine operated on CNG and Diesel simultaneously using the Homogeneous Charge Compression Ignition Technology (HCCI). Apart from this, the alternate fuels cost low compared to diesel and gasoline. Looking at all these benefits offered by alternate fuels and achieving decreased emission limits, the demand for alternate fuel construction equipment would increase over the next few years.

Crawler excavators would be the largest construction equipment type over the forecast period.

The crawler excavators are estimated to showcase a market share of >25% in 2022 and are projected to grow by 2027. Rapid urbanization is the key factor contributing to the growth of the crawler excavator market. The crawler excavator due to its chain belt setup offer stability in operation specially in rough terrain and muddy areas. The stronger gradeability of crawler excavators make is capable for usage in residential constructions as well as the underground mining projects. The crawler excavator act as an all-round construction equipment that can be used to dig sites, demolish structures and surfaces, carry out trenching and also lifting heavy objects. The excavators are available in wide range of engine capacities like below 5 tons, 5-10 tons and above 10 tons of capacity. Asia is expected to be the largest market for crawler excavators, owing to the increase in infrastructural developments and the rapidly growing real estate business in the region. Thus, heavy investment in infrastructure development in the construction and mining industry would drive the demand for crawler excavators during the forecast period.

Growth in infrastructure developments to increase the sale of construction equipment

The construction equipment market has grown gradually after the Covid-19 period due to the resumption of halted construction projects and planned new investments in the construction sector as part of the infrastructure development activities. Some factors influencing the growth of construction equipment manufacturers include investments in infrastructure, residential and commercial infrastructure, and an increment in institutional capital expenditures globally. US, UK, China, and India have increased construction activities in different areas. For instance, the US infrastructure has been under the spotlight. In November 2021, the US government declared an approximately USD 1 trillion plan with 4,300 projects underway with more than USD 110 billion in funding as a part of the infrastructure investment package. Therefore, such planned investments and growing construction activities for infrastructure development would drive the demand for construction equipment during the forecast period.

International trade policies and regulations

The policies and regulations on manufacturing, import, and export of construction equipment differ country-wise. Countries impose various import duties for international trade to avoid unfair competition and provide an advantage to local manufacturers. Generally, governments enter into bilateral trade agreements with other countries to reduce tariffs and barriers to a free trade area or common market. This can be helpful but can also lead to increased competition from abroad. Foreign affairs affect trade activities to a larger extent. In the case of disputes with countries, the trade agreements may get suspended, or in extreme cases, restrictions may be imposed, which limits the trade altogether. Therefore, the impact of the international trade policies and regulations create restraining factors for the sale and development of the construction equipment market in many countries.

Trend for the autonomous construction equipment

The construction equipment market is witnessing a lot of technological advancements for more optimized and reliable products. The demand for automated solutions is growing as it helps increase productivity with minimum effort and reduced errors. Autonomous operating technology is gradually gaining popularity in the off-highway operating vehicle segment. Construction work is well-suited for autonomous machinery as the tasks are repetitive, physical, precise, and time-sensitive. This is driving the demand for the development of autonomous construction equipment. Manufacturers are developing autonomous construction equipment which works on wireless communication technologies by interfering with radio signals from other equipment, receiving commands, and reporting status. It assures improved safety, increased productivity, and reduced unscheduled maintenance. Therefore, the trend for autonomous construction equipment would create an opportunity for the construction equipment market to develop and grow during the forecast period.

CHALLENGE: Fear of Cyberattacks

With the advent of semi-autonomous and autonomous construction equipment, implementing IoT devices and remote-control software with online connectivity can increase the cyber-attack threat. According to the report titled- a security analysis of radio remote controllers for industrial applications, 2019- by Trend Micro Research (TMR), radio frequency-controlled heavy construction equipment is more biased toward safety than security. Attacks such as malicious re-programming, e-stop command, command injection, and replay commands are the most common threats in automation technology.

Wheeled loaders <80 HP are estimated to have the second largest market share

The wheeled loaders <80 HP equipment type segment is estimated to have the second largest market share of 23.4% in 2022 in the construction equipment market. This construction equipment is used primarily for loading/unloading and bulk material movement in construction, quarry, and crushers. They are widely used in large scales infrastructure projects such as roads and highways, railways, dams, ports, and airports. Also, government initiatives in infrastructural developments have further driven the demand for wheeled loaders <80 HP. Thus, the low-cost, compact size and less maintenance are expected to bolster the demand for wheeled loaders <80 HP in construction activities.

The material handling equipment category would be the second largest segment during the forecast period.

The movement of material at construction sites includes the movement of heavy rods, bricks, sands debris, soil, and other such material. Material handling actions include storing, controlling, and protecting materials, goods, and products in manufacturing, distribution, consumption, and disposal. Material handling equipment like articulated and rigid dump trucks are considered under the material handling equipment category. Rising industrial construction activities and the development of commercial projects would drive the demand for the material handling equipment category segment during the forecast period.

The Middle East would be the fastest-growing Construction Equipment Market from 2022 to 2027.

The Middle East is estimated to be the fastest growing market for construction equipment from 2022 to 2027 due to the increased construction activities for infrastructure development. Saudi Arabia, UAE, and Qatar largely contribute to the sale of construction equipment in the Middle East. The Middle East has witnessed a boost in construction equipment sales in 2020-2021. The large infrastructure development projects like artificial beaches, luxurious hotel chains, road construction, and other such activities undertaken by the government as well as private organizations are the factors that would increase the demand for construction equipment in the Middle East by 2027. With such increased construction activities, the crawler excavators and wheeled loaders are estimated to be the largest selling equipment in the Middle East market by 2027.

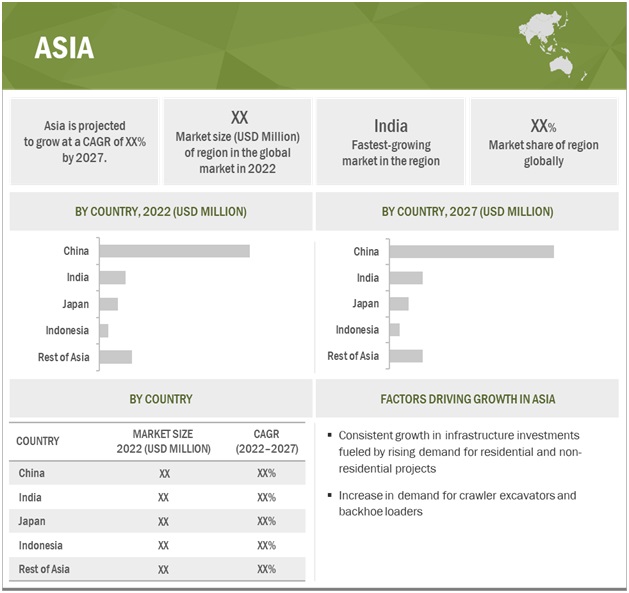

Asia is projected to be the largest market by 2027

Asia is projected to be the largest construction equipment market by 2027 due to large investments in construction projects in growing economies such as India and Indonesia. At the same time, other countries in the region, such as China and Japan, are also implementing many new development projects to improve the country’s infrastructure. Furthermore, many global construction equipment OEMs have their base of operations in the region. Therefore, due to such impressive growth in the construction activities across the region, Asia is projected to have the largest market share of the market during the forecast period.

Source: PR Newswire

Copyright 2017-2023 All rights reserved.

Copyright 2017-2023 All rights reserved.