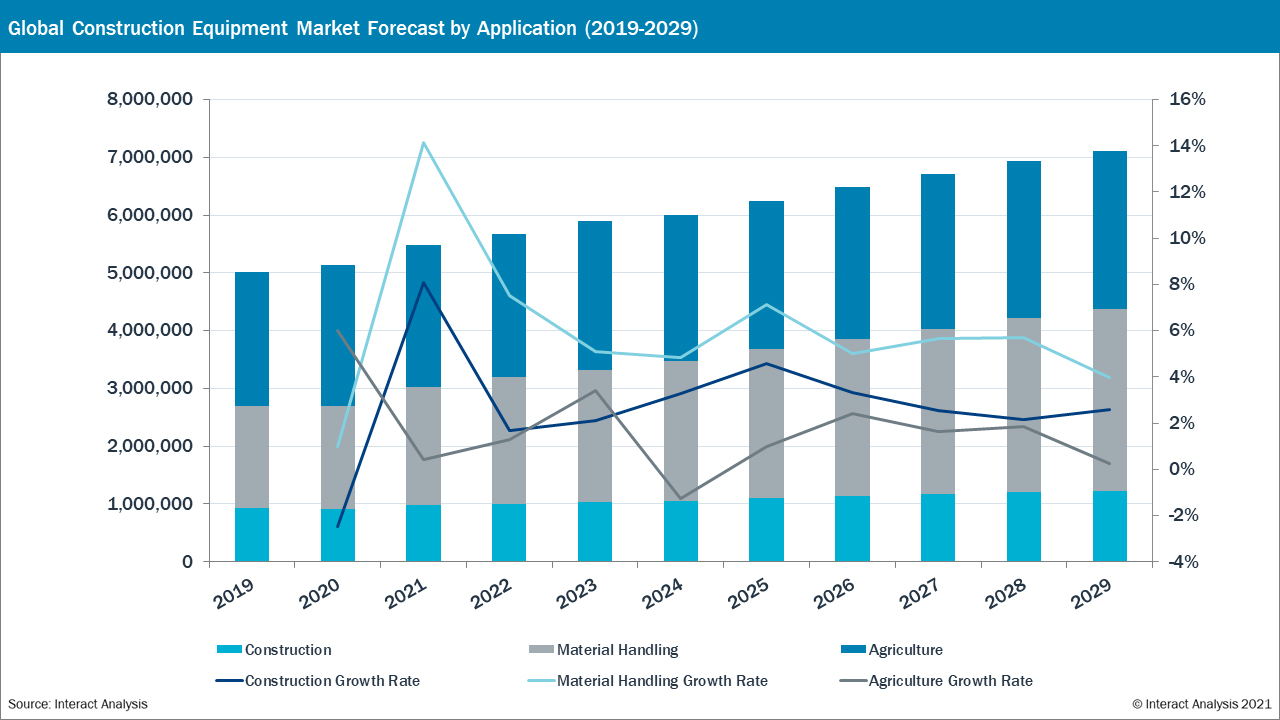

Interact Analysis has released a new report, The Off-Highway Vehicles Market, showing that, due to the impact of the pandemic, market growth slowed to 2.6% in 2020, but will recover to 6.5% in 2021. In the long term, the CAGR between 2019 and 2029 is forecast to be 3.6% in unit shipment terms.

The slow 2020 growth rate saw global sales of construction equipment being hit particularly hard in most regions except China, owing to the closure of construction sites and cancellation of events to control the spread of the virus. But global sales of construction equipment were recovering in the second half of 2020 which is why recovery of the order of 6.5% for the whole off-highway vehicle sector is predicted for 2021. Stringent anti-virus measures meant that China was the only major region to buck the global downward trend in 2020, and most of its construction and manufacturing activities recovered to a normal level as early as May. Overall, for example, China reported 37% growth in excavator sales, and 40% growth in telehandlers.

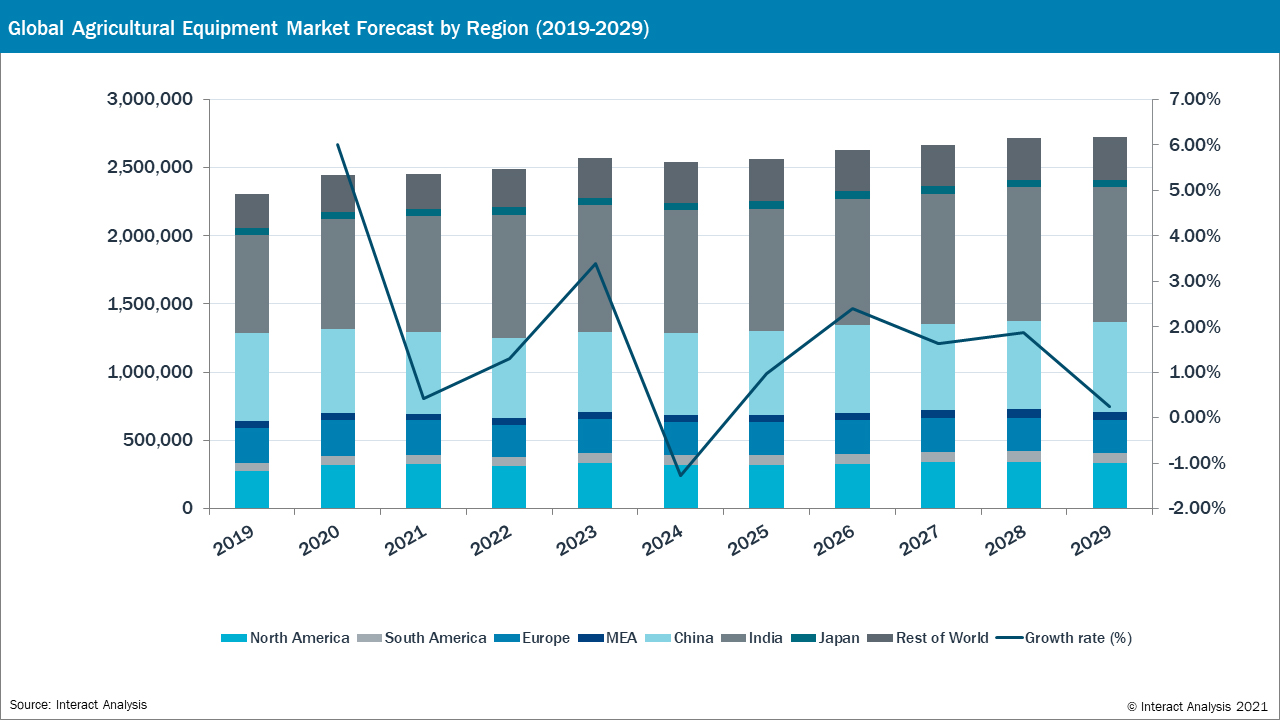

Agricultural machinery (which is a new addition and was not covered in the previous version of this report) currently occupies the largest segment of the off-highway market and it was the only category in the sector to have a relatively strong 2020 on a global basis. In spite of Covid induced factory slow-downs and closures, global farm machinery sales grew in 2020 owing to good weather and strong crop production, and the need to replace aging machinery. Some of the strongest growth figures for the sector include 17% for tractors in North America and 24% for combined harvesters in Europe. The longer-term forecast is expected to be positive for farm machinery as the rate of mechanization increases in developing markets, but Interact Analysis predicts that the overall volume of material handling equipment sales will surpass that of agricultural equipment from 2025 as online shopping, e-commerce, and warehouse automation spur the demand for light equipment such as forklift trucks.

Discussing the prospects for vehicle electrification in the sector, Alastair Hayfield, Senior Research Director at Interact Analysis, says:

“While we predict that over 36% of shipments of off-highway vehicles will be electrified equipment by 2029, the overwhelming majority of these will be smaller vehicles, where battery technology is more suitable. Electrification of compact construction vehicles offers many benefits, minimizing emissions and noise levels, allowing the equipment to be used in enclosed environments such as inside buildings and in other noise-sensitive areas. For many of the environments where material handling typically works, such as airports and logistics centers, there is already a high demand for ‘greener’ equipment. These places will continue to adopt electrification very aggressively. Electric tractors may make inroads in some agricultural scenarios, but agriculture faces other challenges on the pollution front, such as enteric fermentation, the production of methane by farm livestock, next to which pollution from diesel-powered machinery pales into insignificance”.

The research was conducted during the period September 2020 – February 2021.

Copyright 2017-2023 All rights reserved.

Copyright 2017-2023 All rights reserved.