In collaboration with Exkavator.ru, we host analysis on the Russian market

Exkavator.ru is among the most authoritative magazines of Russia in the field of machinery and construction equipment

***

The purpose of the material is to tell briefly and objectively about the structure of offers and the cost of bulldozers on the Russian market.

Today it’s obvious to everyone that if the supplier isn’t online, he’s nowhere to be found. The reviews and graphs presented in this article are a record of supplier activity and the structure of offers on the Internet, not the final sales results. The data are based on a cut of current ads posted in March on all major Russian Internet sites: Avito, Drom, Avto Ru, and Excavator Ru, as well as websites of official dealers.

In cases where sellers bind prices for equipment to the current dollar or euro rate, average monthly ruble rates are used for calculation.

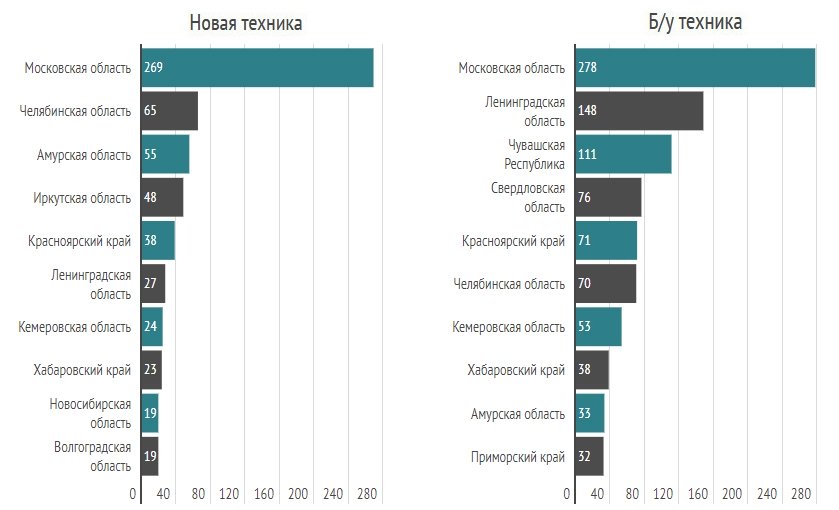

Regions of Russia. A number of offers of new and used bulldozers.

The largest number of ads for new bulldozers was recorded in the Central Federal District. The Far Eastern Federal District was in second place, and the Siberian region was in third place. As for second-hand machinery, the TOP 3 includes the same regions, but in a slightly different order: Far Eastern District is on the second position, on the third is Siberian District.

The leader among the subjects of the Russian Federation is the Moscow. The Saint-Petersburg was in the 6th place in the segment of new equipment, in the segment of used equipment – in the 2nd place.

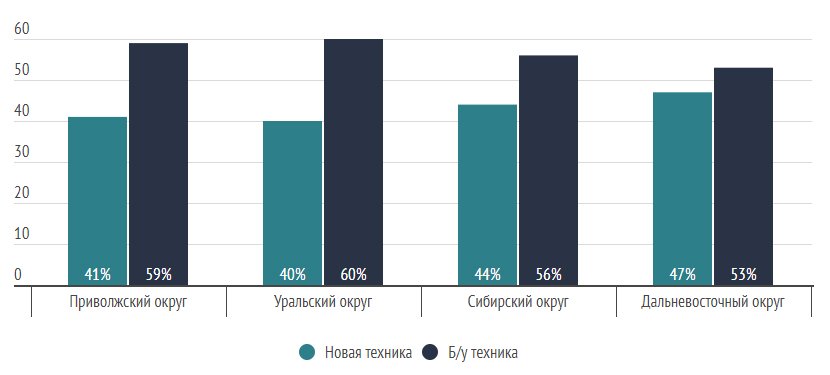

In the Northwestern Federal District, classifieds for used equipment prevailed. In the Central, Southern, and North Caucasian districts new bulldozers were given priority.

Structure of proposals. Brands and age of technique

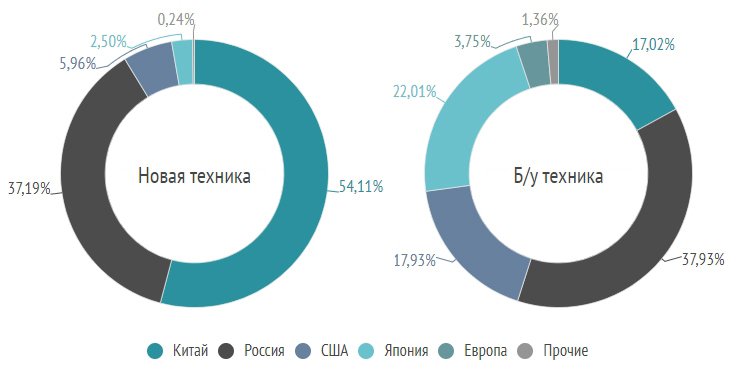

Chinese bulldozers have taken a leading position in the new equipment market. In the segment of machines that were in operation, the first place is occupied by russian equipment. At the same time, there were no new bulldozers assembled in Europe in the period under review.

It should be noted that we classify the manufacturer to a certain region of the world depending on the location of its head office: SHEHWA (China), Shantui (China), Pengpu (China), Zoomlion (China), Caterpillar (USA), Case (USA), John Deere (USA), Liebherr (Europe), Komatsu (Japan), CHTZ-Uraltrac (Russia), CHETRA (Russia), VGTZ (Russia), DST-Uraltrac (Russia) and others. Other regions: Beldozer (Belarus), MTZ (Belarus), and other brands.

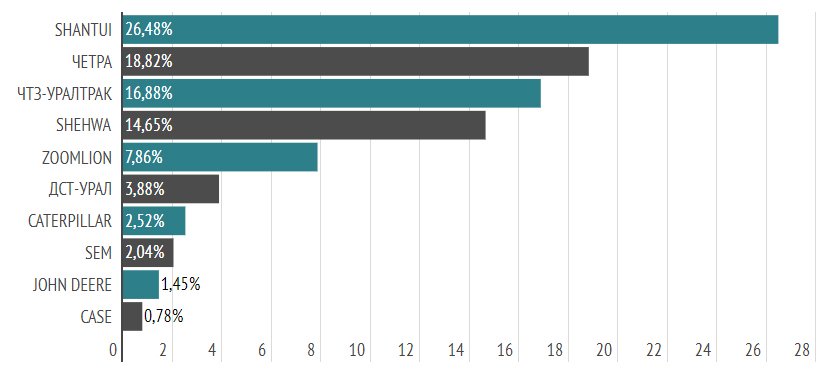

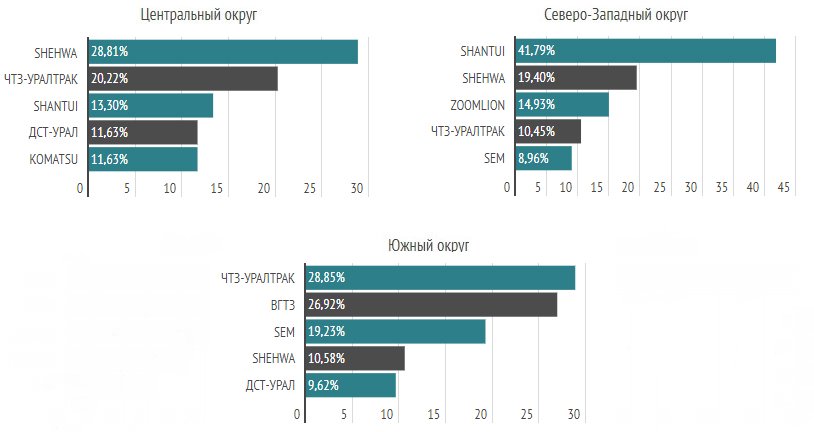

The top 10 manufacturers (new bulldozers) include Chinese, Russian and American brands. At the same time, the greatest number of vehicles was Shantui brand, the second and third places were occupied by russian manufacturers – CHETRA and CHTZ-Uraltrac.

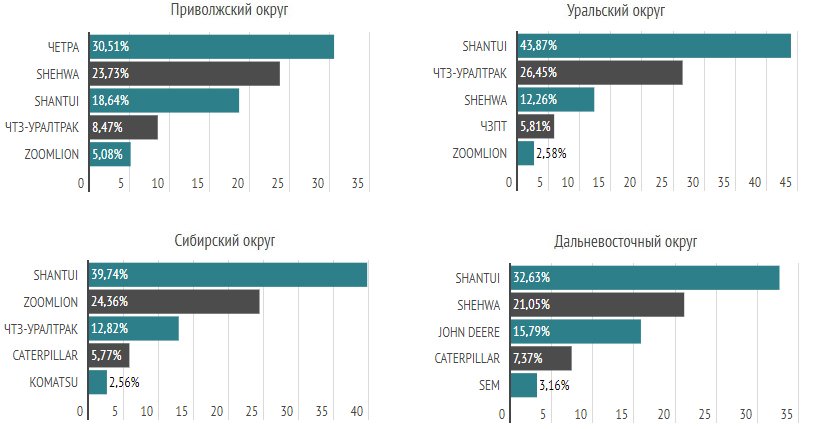

In the Central and North-Western regions of Russia, Chinese brands Shehwa and Shantui took first place, and in the South of Russia – CHTZ-Uraltrak, respectively. In the North Caucasian Federal District, only new Shantui and CHTZ bulldozers were offered for sale. In other regions, with the exception of the Volga region, where CHETRA bulldozers were in the first place, the Chinese brand Shantui was in the lead.

TOP 5 brands in Russian districts (new equipment)

In the segment of used equipment, the first place was taken by Komatsu brand. The total share of domestic brands in the TOP-10 was 34.79%.

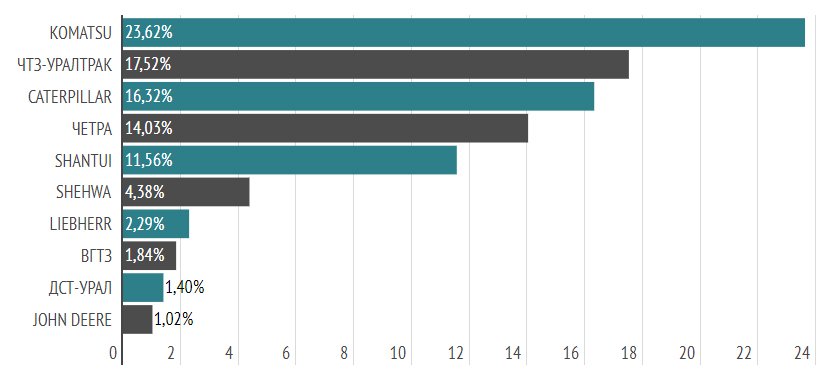

Komatsu equipment (used equipment segment) has found itself in the leading positions in almost all regions of Russia (except North-Western, Volga, and Siberian districts). In the North Caucasian region, only Shantui machinery was offered for sale.

TOP 5 brands by Russian districts (used machinery)

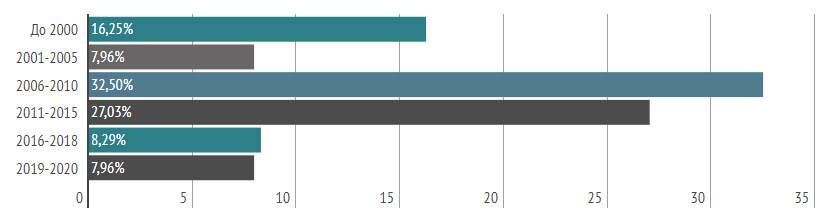

In more than 30 percent of cases, sellers offered bulldozers produced between 2006 and 2010.

It’s a price issue. The cost of bulldozers depending on the region of production, year of production

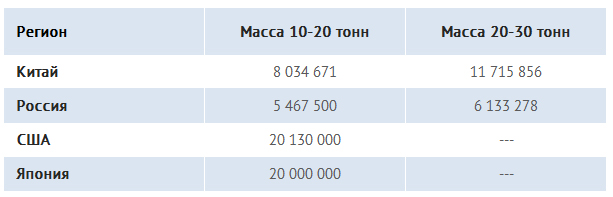

The share of ads on the sale of bulldozers of American and Japanese production weighing 10-20 tons was 5.96% and 2.5% respectively. In the class of 20-30 tons of equipment from these regions were not represented.

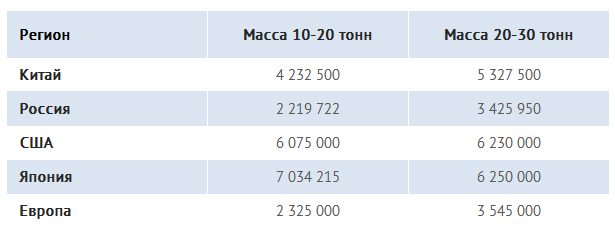

In the segment of used equipment, the choice of brands was wider. At the same time, Japanese machines were leading in the class of bulldozers weighing 10-20 tons, while 20-30 tons bulldozers were represented to a greater extent by Russian equipment.

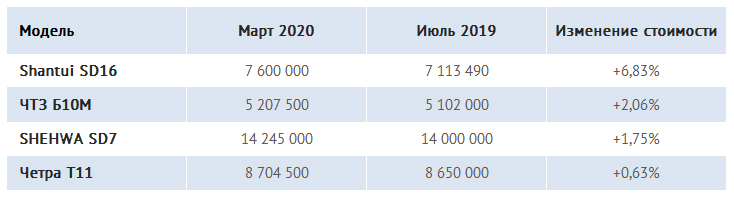

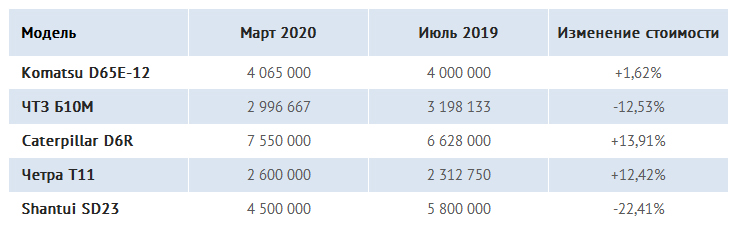

The average cost of various bulldozer models (new equipment) increased by 7% maximum over 9 months.

As for the equipment in operation, there has been an increase in value in almost all the items under consideration. The exception – Russian bulldozers CHTZ B10M, which for 9 months lost an average of 12.5% in value.

In the segment of machinery, which is more than 15 years old, the bulldozers of Chinese production were not presented.

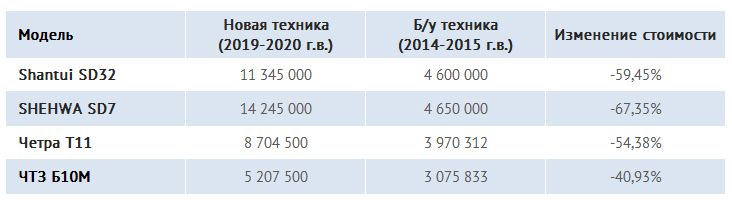

We will compare the dynamics of the cost of new bulldozer models produced in Russia and China, because their share in the segment of machines without working hours is greater than that of others. Over 5 years of operation Chinese models are on average 50.05% cheaper, while bulldozers produced at Russian plants – by 47.65%.

Source: exkavator.ru

Copyright 2017-2025 All rights reserved.

Copyright 2017-2025 All rights reserved.